The smart Trick of Retirement Income Planning That Nobody is Discussing

Table of ContentsIndicators on Retirement Income Planning You Need To KnowThe Main Principles Of Retirement Income Planning The Retirement Income Planning StatementsGet This Report about Retirement Income PlanningGetting The Retirement Income Planning To WorkThe 8-Minute Rule for Retirement Income Planning

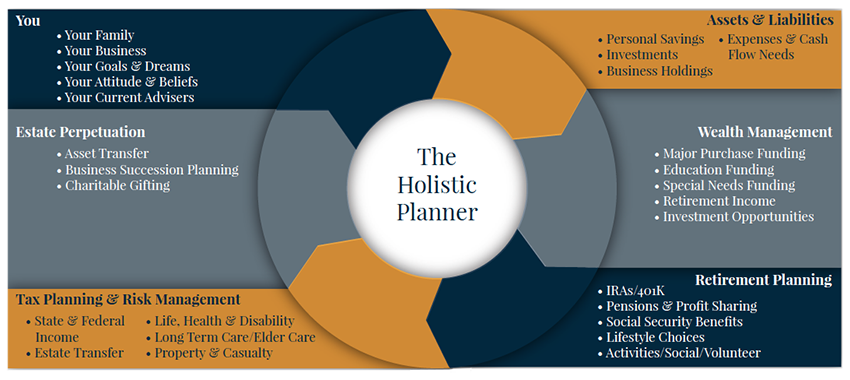

Retired life preparation considers not only properties and income but also future expenditures, obligations, as well as life span. If you are under 50, you can contribute an optimum of $22,500 in 2023 to a $401(k). In the simplest feeling, retirement planning is what one does to be planned for life after paid work ends.The non-financial facets consist of way of living options such as exactly how to spend time in retirement, where to live, as well as when to quit functioning completely, to name a few things. An alternative approach to retirement preparation considers all these locations. The emphasis that one places on retirement planning changes at different stages of life.

As an example: Individuals used to state that you need around $1 million to retire pleasantly. Various other specialists use the 80% rule, which mentions that you need sufficient to survive 80% of your revenue at retirement. So if you made $100,000 annually, then you would need cost savings that can create $80,000 each year for approximately 20 years, or a total amount of $1.

The Only Guide to Retirement Income Planning

Others say most senior citizens aren't saving anywhere near sufficient to satisfy those standards and ought to readjust their way of life to reside on what they have. While the amount of money you'll desire to have in your nest egg is important, it's additionally a great idea to take into consideration every one of your expenses.

The 8-Minute Rule for Retirement Income Planning

It's constantly a great suggestion to make any type of modifications whenever there's a change in your way of life as well as when you enter a various stage in your life. Retirement accounts come in many forms and sizes.

You can as well as ought to contribute greater than the quantity that will gain the employer match. Some experts suggest upward of 10%. For the 2023 tax obligation year, participants under age 50 can contribute as much as $22,500 of their profits to a 401(k) or 403(b), a few of which may be furthermore matched by a company.

The traditional private retirement account (IRA) allows you deposit pre-tax bucks. This means that the cash you conserve is deducted from your earnings prior to your tax obligations are secured. It reduces your taxed income and, as a result, your tax obligation liability. If you're on the cusp of a higher tax obligation brace, buying a standard individual retirement account can knock you to a lower one.

Examine This Report about Retirement Income Planning

When it comes time to take circulations from the account, you are subject to your common tax obligation rate at that time. Bear in mind, however, that the cash grows on a tax-deferred basis - retirement income planning. There are no capital gains or returns taxes that are examined on the balance of your account till you start making withdrawals.

Circulations need to be taken at age 72 as well as can be taken as early as 59. You are subject to a 10% charge if you make withdrawals prior to that.

A Roth IRA can be an exceptional device for young adults, moneyed with post-tax dollars. This gets rid of the prompt additional reading tax obligation deduction yet avoids a more considerable income tax bite when the cash is taken out at retirement. Beginning a Roth IRA early can repay majorly over time, also if you do not have a whole lot of money to spend in the beginning.

Retirement Income Planning Things To Know Before You Buy

Roth IRAs have some restrictions. The payment restriction for either individual retirement account (Roth or typical) is $6,500 a year, or $7,500 if you more than age 50. click this site Still, a Roth has some revenue limits: A solitary filer can contribute the sum total just if they make $129,000 or much less yearly, as of the 2022 tax obligation year, as well as $138,000 in 2023.

The EASY IRA is a retirement account supplied to employees of small services in lieu of the 401(k), which is pricey to preserve. It functions the very same means a 401(k) does, permitting staff members to conserve cash instantly via payroll reductions with the alternative of a company match. This amount is capped at 3% of an employee's yearly income.

Catch-up contributions of $3,500 enable employees 50 or older to bump that restriction up to $19,000. When you established up a retired life account, the question ends up being exactly how to route the funds.

Getting The Retirement Income Planning To Work

Below are some standards for successful retirement preparation at different stages of your life - retirement income planning., which is an essential and also valuable item of retired life cost savings.

Even if you can just put aside $50 a month, it will certainly deserve click here to read three times more if you spend it at age 25 than if you wait to start spending up until age 45, many thanks to the pleasures of intensifying. You may be able to invest more money in the future, however you'll never ever be able to make up for any type of lost time.